👋 Henry here, welcome to B2B Growth Insights, where I run you through case studies on how B2B SaaS companies changed their pricing or top of funnel to accelerate growth.

In today’s edition: We break down how Beehiiv, the newsletter platform, has usurped competitors like Substack, despite their first mover advantage. Beehiiv’s success is a masterclass in counter positioning and properly extracting value from your customers to drive revenue growth.

Total reading time: 7 minutes

Not a subscriber yet? Sign up below to receive next week’s deep dive.

Who are Beehiiv?

In 2020 Tyler Denk was leading growth at the Morning Brew, a business newsletter with 3m+ subscribers. He had spent the past couple of years building out a ton of custom tools to better enable the Morning Brew to grow such as their infamous referral scheme.

But in 2021 shortly before Morning Brew’s acquisition Tyler Denk left to found Beehiiv, along with friends Max Sklar, Andrew Platkin and Jacob Wasserman to build a newsletter publishing platform empowering all newsletter creators with these advanced tools previously reserved for organisations with entire engineering departments.

The Weaknesses with Beehiiv’s Competitors

The Beehiiv founders were under no illusion the space they were entering was crowded. There were traditional incumbents like ActiveCampaign, MailChimp and ConvertKit, that had established themselves as products for companies launching email newsletters along with newer entrants largely appealing to independent writers like Ghost & Substack, who raised $65m from the likes of Andreessen Horowitz at the time Beehiiv was being founded.

Substack in particular was built with the mission to enable anyone to start publishing for $0 and so monetised by taking a 10% cut of whatever writers made from premium subscription revenue.

Whilst this business model attracted hundreds of thousands of writers to the platform in covid-19 there were a few flaws with this approach.

First, and you could probably guess this but premium newsletter content is a pretty small market just because of the sheer difficulty in producing content that justifies a long-term subscription when competing with the likes of both paid media (Netflix, Amazon Prime, New York Times) as well as free media (YouTube, TikTok, free news websites and newsletters).

We’ve seen over the past 5 years traditional media organisations have become shells of their former selves because of this fact and whilst it’s nice to think people will support journalists, independent or not, this isn’t the reality for the most part.

As a result by the end of 2021 after attracting hundreds of thousands of writers, Substack's Top 10 Writers were only earning $20m per year, collectively. They later told Axios that they were on pace to generate only $9m by the end of 2021. Ouch…

The other major problem was that the business model was inherently flawed. In the unlikely case a writer does start to find success and has thousands of people willing to subscribe for their premium content then why would they stay when Substack charges 10% of every dollar they ever make?

This means that you’re actively incentivising your biggest creators, the ones who somehow made premium content feasible, and whom your brand is built on, to leave and find a newsletter solution that will charge a flat SaaS fee to save wastage.

Beehiiv’s Core Insights

Substack was appealing to the lowest common denominator, price conscious and less advanced writers meaning their publisher platform was focused around simplicity.

Denk and his cofounders recognised this fact and noticed that all the large media acquisitions in recent years, both in the world of traditional media and newsletter, were ad-based publications opting for them to take a different approach.

To target serious creators and justify a traditional SaaS fee required another core insights from the Beehiiv team.

Whilst core publishing capabilities were being rapidly commoditised and was a highly competitive market the tools required to successfully grow and monetise a newsletter were fragmented, and had a high willingness to pay where it was much easier to justify a $39/mo price tag if the platform would help you make 5x that.

This all-in-one approach: write, publish, grow, monetise, they realised, would eliminate the need for multiple subscriptions and disjointed workflows, empowering creators to focus on content and audience engagement while Beehiiv would handle all the technical and operational complexities enabling them to justify a $39/mo starting price for their software.

Beehiiv continued in this vein and priced aggressively vs Substack and competitors in 2 super interesting ways:

They charge absolutely nothing for premium subscriptions generated on the Beehiiv network. By doing this there’s now no real reason to stay with Substack over Beehiiv if you’re making more than $390/month.

Beehiiv are able to increase customer LTV over time through features that enable writers to make money with which they have major distribution and integration advantages over 3rd party products. They’re super careful here to only charge a % of revenue generated for products where they really add value, namely co-registration and Ads (15-20% take-rate) where they are providing you revenue opportunities through their network. Substack, in contrast, charges 10% of revenue even if you do the work of finding a subscriber to pay for your content. This enables Beehiiv to grow with their creators as they scale unlike Substack, eliminating this churn from success issue.

Whilst analysing Substack almost exactly 2 years ago the problems were already pretty clear. On July 1st I wrote 2 recommendations for how they should better monetise. Denk & Beehiiv have built these exact features out with their Ad Network & Boosts product.

What Beehiiv Does Well

Now, let’s look into what Beehiiv does well, and not so well on their pricing page today.

Pricing Evolution to 2-Axis Value Metric

Whilst Beehiiv started with a simple 2-tier pricing plan, where newsletters with up to 10k subscribers would be paying $42/mo and those between 10-100k subscribers would pay $84/mo this meant they were leaving a LOT of money on the table.

They’ve now adjusted their pricing to better increase LTVs, by becoming much more granular on the usage limits. For example a newsletter with 35k subscribers will now have to pay a minimum of $199/mo vs $42 originally.

The other dimension is now feature gating. Instead of simply putting you in a plan based on subscriber numbers they’ve now got a pricing model which enables them to make more money from power users (for features such as priority support and their course) with a cheaper, more affordable tier to reduce the disruption & churn risk for those that aren’t power users.

What Could They Improve?

Anchor Users Artificially Higher

Whilst Beehiiv have worked pretty tirelessly over the past 3 years to build one of the most integrated newsletter publishing suites, $39/mo is not an insignificant amount of money to a lot of people.

To reduce the pain a user may see when seeing the cost of the ‘Scale’ plan what Beehiiv could do is show the more expensive pricing tiers first, anchoring you to a higher price point thus making the ‘Scale’ plan seem affordable in comparison. Humans naturally have a tough time quantifying the value of software, especially when they likely don’t know the prices of other newsletter platforms and so tend to rely on imperfect comparisons.

A small change but it makes a big difference.

Include Social Proof

Seeing that their pricing page had no form of social proof was a surprise to me. Their CEO has mentioned multiple times the fact they were highly strategic in raising capital from newsletter creators like Scott Galloway and Shaan Puri and in the years since have managed to build up an impressive roster of public figures.

So why do they not highlight this on their pricing page?

It’s a huge credibility marker that large newsletters trust & use the Beehiiv platform over competitors, making it a brand aspiring newsletter creators want to associate with and can be a massive conversion booster.

Default Select Annual Plan

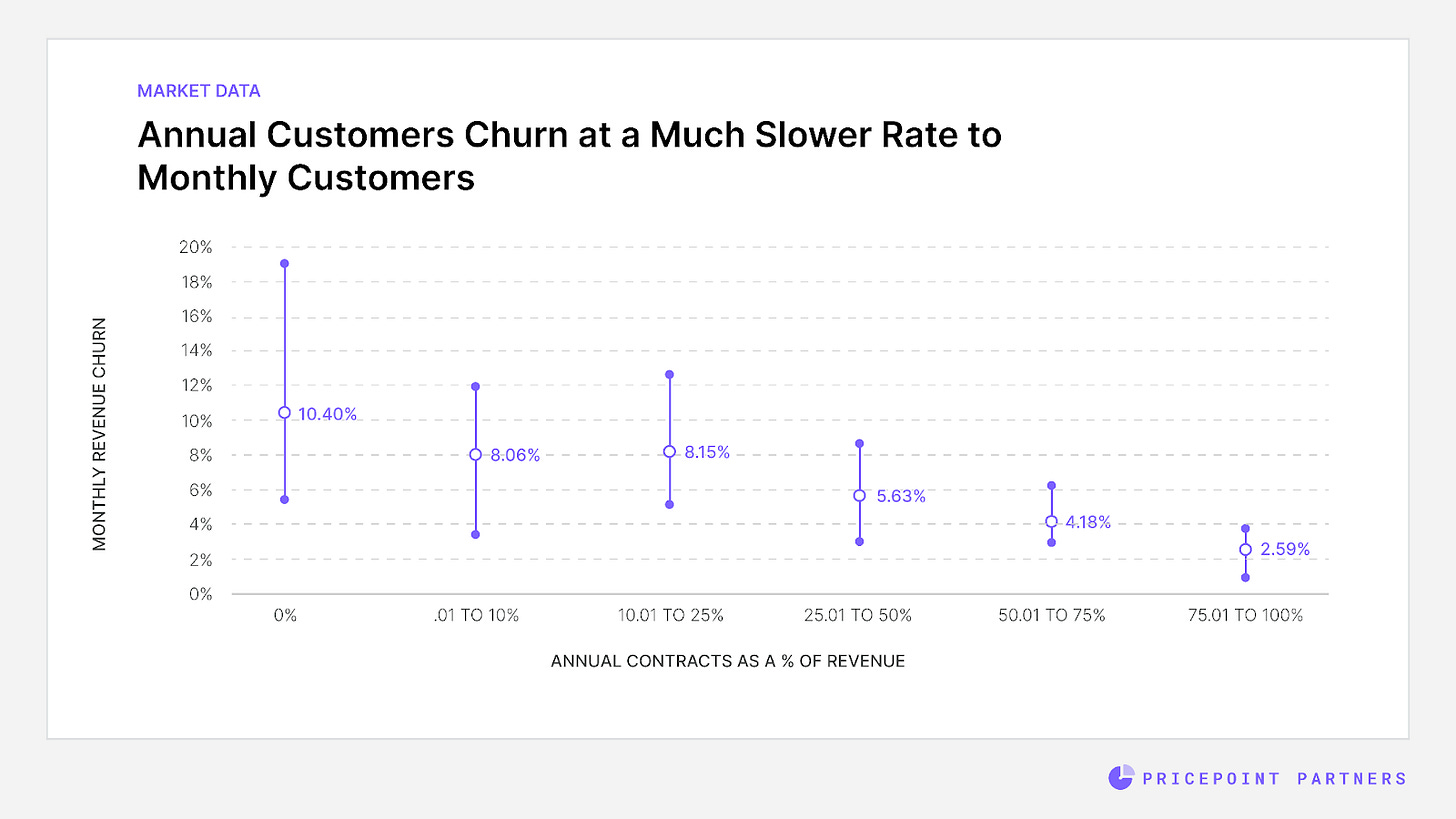

It should Beehiiv’s goal with the pricing page to not only convert someone to a paid plan but to do everything they can to convince a user to convert to their annual plan. Annual plans, especially amongst consumer/prosumer tools have a massive effect on churn rates and overall customer LTV, even with aggressive discounts on the annual plan.

How can they do this? 2 main ways:

Defaults matter. When you visit the pricing page the monthly plan & their prices are shown as default, and this is the exact opposite of what should be happening. It should be defaulted to the annual plan showing you a better price per month and reducing the consideration needed to commit to the annual plan.

Better highlight the money saved if a user converts to an annual plan. Beehiiv should be quantifying this in dollars saved or months free, not % off (the most common) which is less tangible. Data shows that %-based discounts are the least effective of all 4 major forms so at least experiment with other offers before committing to them!

4. Add Purchase Buttons Above the Fold

Whilst Beehiiv do so much so well in the field of pricing it’s baffling to me that they don’t have their purchase buttons above the fold. It’s a massive commitment to sign up to a newsletter platform and this likely means it takes a lot of work for Beehiiv to sign up new writers. You would think then they would want to make the process as easy as possible and all they’re doing by putting purchase buttons below the fold is hurting conversions.

It’s an unfortunate fact that 60%+ people don’t scroll down to check out what’s below the fold. For impulse decision makers and those ready to commit, stop hurting your conversion rate and make those big juicy buttons visible the very first second someone lands on the pricing page.

That’s it for today folks, hope you enjoyed!

👋 Ciao, Henry